Introduction

For many aspiring homeowners, finding the perfect home can be a challenge—especially in today’s competitive real estate market. Often, the ideal property needs repairs or renovations before it becomes truly livable. That’s where the FHA 203k loan comes in. A government-backed renovation loan, the 203k loan helps borrowers finance both the purchase (or refinance) of a home and the cost of renovations with a single mortgage. While Rocket Mortgage does not currently offer the 203k loan as of 2025, this article explores everything you need to know about the loan, including alternatives Rocket Mortgage does offer, how the 203k works, eligibility, and tips for financing fixer-upper homes.

Purchasing a home that needs repairs can be intimidating, but it also presents an exciting opportunity to build equity, customize your space, and potentially buy in a desirable location for less. FHA 203k loans are a helpful tool for financing these fixer-uppers—but what happens when you want the speed, customer support, and digital convenience of a lender like Rocket Mortgage? While Rocket Mortgage does not directly offer 203k loans as of 2025, this addition guide will walk you through expanded information on how to approach FHA renovation financing, complementary Rocket Mortgage products, how to plan your project, and how to navigate the broader landscape of 203k lending in today’s market.

– Understanding the Expanded Role of FHA 203k Loans in 2025

In 2025, the U.S. housing market continues to face inventory shortages, particularly in affordable segments. As a result, more buyers are turning to properties in need of work. FHA 203k loans have become increasingly popular among:

- Millennials and Gen Z buyers entering the market

- Investors flipping homes as primary residences (occupancy required)

- Buyers in gentrifying urban neighborhoods

The 203k loan offers a path to affordability and personalization, helping borrowers acquire distressed properties and transform them into livable, modern homes.

1. What is an FHA 203k Loan?

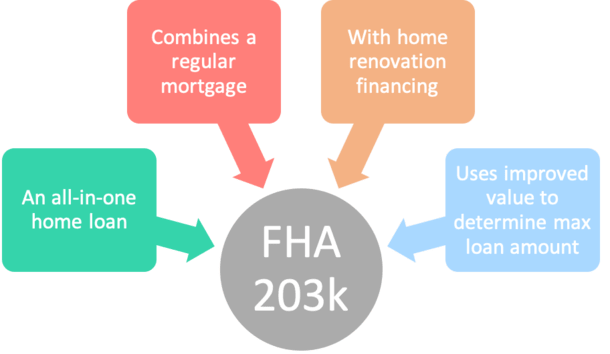

The FHA 203k loan is a unique type of mortgage insured by the Federal Housing Administration (FHA). It allows homebuyers or homeowners to borrow funds to purchase and renovate a home, or refinance an existing mortgage with renovation costs included.

There are two types of 203k loans:

- Standard 203k: For major repairs and structural renovations.

- Limited 203k: For non-structural improvements under $35,000.

2. Who is the 203k Loan For?

This loan is ideal for:

- First-time homebuyers purchasing fixer-uppers

- Homeowners seeking to renovate without taking out a second loan

- Buyers investing in underdeveloped or foreclosed properties

3. Rocket Mortgage and the 203k Loan in 2025

As of 2025, Rocket Mortgage does not directly offer FHA 203k loans. However, they may partner with other lenders or provide referrals. Homebuyers interested in a 203k loan must work with FHA-approved lenders who specialize in renovation loans.

4. Rocket Mortgage Alternatives to 203k Loans

While Rocket Mortgage does not offer 203k loans, they provide other financing options that may suit renovation purposes:

- Cash-Out Refinance: Refinance your home for more than you owe and use the difference for renovations.

- Home Equity Line of Credit (HELOC): Access funds as needed for home improvements.

- Personal Loans: Unsecured loans for smaller renovation projects.

- Renovation Conventional Loans: Fannie Mae’s HomeStyle loan or Freddie Mac’s CHOICERenovation loan (may be offered via Rocket’s partners).

5. FHA 203k Loan Requirements

To qualify for a 203k loan, you must:

- Have a credit score of 580 or higher (some lenders may require 620+)

- Use the home as a primary residence

- Have a debt-to-income ratio under 43%

- Hire a licensed contractor for the renovations

- Complete all work within 6 months

6. Eligible Renovation Projects

Common improvements allowed under 203k loans include:

- Roof repair or replacement

- Plumbing and electrical upgrades

- Kitchen and bathroom remodeling

- Flooring replacement

- Structural repairs

- Energy efficiency improvements

7. Ineligible Projects

Certain luxury or non-essential upgrades are typically not allowed:

- Swimming pools

- Outdoor kitchens

- Tennis courts

- Fire pits

8. How the FHA 203k Loan Process Works

- Pre-Approval: Find an FHA-approved lender

- Find a Property: Home must qualify under FHA standards

- Hire a Consultant (for Standard 203k): Required to assess the scope and feasibility

- Contractor Estimates: Must be licensed and provide detailed cost breakdowns

- Appraisal: Based on the post-renovation value

- Underwriting & Approval

- Closing: Funds placed in escrow

- Renovation Phase: Disbursements made to contractors as work progresses

9. Loan Limits and Terms

Loan amounts are subject to FHA county loan limits. As of 2025:

- Low-cost areas: $498,257 (single-family)

- High-cost areas: Up to $1,149,825

- Terms: 15 or 30 years, fixed or adjustable rate

10. Benefits of the 203k Loan

- One loan covers purchase and renovation

- Low down payment (as little as 3.5%)

- Fixed interest rate for long-term affordability

- Allows buyers to build equity faster

11. Drawbacks to Consider

- Lengthy approval process

- Requires detailed contractor bids

- FHA mortgage insurance premiums (MIP) apply

- Must use the property as a primary residence

12. FHA 203k vs. Rocket Mortgage’s Cash-Out Refinance

| Feature | FHA 203k Loan | Cash-Out Refinance (Rocket) |

|---|---|---|

| Use for Renovations | Yes | Yes |

| Purchase & Renovate | Yes | No (refinance only) |

| Minimum Credit Score | 580 | 620+ |

| Owner-Occupied Only | Yes | No (investment allowed) |

| Fixed Interest Option | Yes | Yes |

| FHA Insurance Required | Yes | No |

13. Finding FHA-Approved Lenders for 203k Loans

Although Rocket Mortgage doesn’t offer 203k loans, you can work with approved lenders such as:

- Wells Fargo

- LoanDepot

- Freedom Mortgage

- Fairway Independent Mortgage

Check the U.S. Department of Housing and Urban Development (HUD) website for a full list.

14. Using Rocket Mortgage Tools to Prepare

Rocket Mortgage provides tools and resources to help buyers plan, even if using another lender for the 203k loan:

- Affordability calculators

- Credit score monitoring

- Home search tools

- Pre-approval platforms

15. Combining Rocket Mortgage Products with Renovation Plans

In some cases, borrowers may use Rocket Mortgage’s other offerings for staged renovations:

- Start with a conventional mortgage

- Build equity

- Apply for a HELOC or cash-out refinance to fund upgrades later

16. FAQs About FHA 203k Loans

Can I do the renovations myself? Generally, no. Most lenders require licensed contractors unless you are a qualified builder.

How long does the 203k process take? On average, 45–60 days from application to closing.

What if the renovations cost more than estimated? A contingency reserve (usually 10–20%) is added to the loan to cover overruns.

17. Real-Life Scenario: 203k in Action

Case Study: Sarah, a first-time buyer, found a $210,000 fixer-upper. Using a 203k loan, she borrowed $270,000 to cover purchase and $60,000 in renovations. The home appraised at $300,000 post-renovation. She gained instant equity and moved into a fully updated home.

18. What to Consider Before Choosing a 203k Loan

- Time: Are you prepared for delays and inspections?

- Budget: Can you handle unexpected costs?

- Commitment: Are you ready to live in a construction zone?

- Property type: Condos, townhomes, and single-family homes are eligible; co-ops are not.

19. 203k and the Housing Market Outlook

As of 2025, housing inventory remains tight. The 203k loan is growing in popularity as buyers consider undervalued or distressed properties. Rocket Mortgage and other digital lenders are expected to evolve their product offerings to meet demand for renovation financing.

Conclusion: Should You Use a 203k Loan or Rocket Mortgage Alternatives?

If you’ve found a property that needs work and you want to finance both the purchase and repairs with one loan, the FHA 203k loan is an excellent choice. While Rocket Mortgage does not currently offer this loan, it provides alternatives like cash-out refinancing and HELOCs that can meet similar goals for certain borrowers.

Always compare lenders, evaluate your renovation goals, and assess your financial situation. Whether you choose a 203k lender or explore Rocket Mortgage’s solutions, there are financing paths that make your dream home a reality—even if it needs a little work.